Some of you know my ongoing quest to get my TripIt calendar into my iPhone. I've blogged about workarounds with Outlook 2007 and Exchange, but they all involve some degree of manual work. No more. TripIt helpfully sent me an e-mail last week, giving me a tip on how to add my TripIt iCal feed into my iPhone.

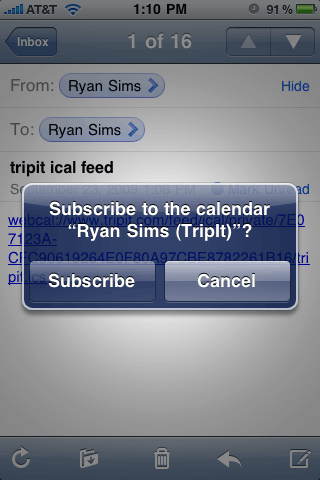

Some of you know my ongoing quest to get my TripIt calendar into my iPhone. I've blogged about workarounds with Outlook 2007 and Exchange, but they all involve some degree of manual work. No more. TripIt helpfully sent me an e-mail last week, giving me a tip on how to add my TripIt iCal feed into my iPhone.The process couldn't be simpler: simply copy the iCal feed from TripIt and send it to yourself n an e-mail you can access on the iPhone. Open the e-mail on the iPhone, and click on the iCal link. The iPhone recognizes it, and allows you to subscribe to the link, adding another calendar to your iPhone. That's it. From then on, your TripIt trip details will automatically update and appear in the subscribed calendar; view all of your Calendars, and you will see your TripIt items overlaid on your other calendars. Simple, and brilliant.

Look, I love the iPhone's TripIt application, and use it constantly. I even love the new USA Today Autopilot app that integrates with TripIt. But to have the itinerary items on your calendar at a glance? Perfect.

Comments